“A goal without a plan is just a wish” – Antoine de Saint-Exupery, French writer

Buying a house, saving for children’s higher education and marriage, retirement planning for self and so on… we all have such financial goals, but it is also true that very few have an understanding on how to meet these goals or make them happen. People having goals need a “financial roadmap” to decide on the best possible options to achieve their financial goals. This is where Financial Planning assumes significance and one requires services of a financial planner for professional advice on one’s journey of goal actualisation.

Financial planning is directed towards making a credible financial plan that lets you meet your financial goals in a time bound manner. It lets you control your financial situation which in turn provides you a greater sense of security with reduced stress. It involves systematic and disciplined investment process that helps in creating wealth over a period of time.

It is always better to plan early. Any delay can derail your journey to become financially secure. Investing your money now will make it easier to achieve your long-term goals.

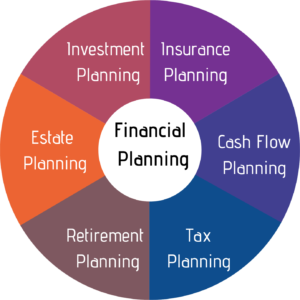

Some of the types of Financial Planning are:

- Investment planning

- Retirement planning

- Tax planning

- Business planning

- Personal Financial planning

Why does one need Personal Financial planning?

Here are some of the reasons:

- Secure one’s family

- Control over cash-flow

- Risk management

- Improve return on investments

- Improve financial acumen and identify errors

- Improve asset allocation

- Improve future visibility

- Plan for emergencies

- Plan for retirement